operating cash flow ratio ideal

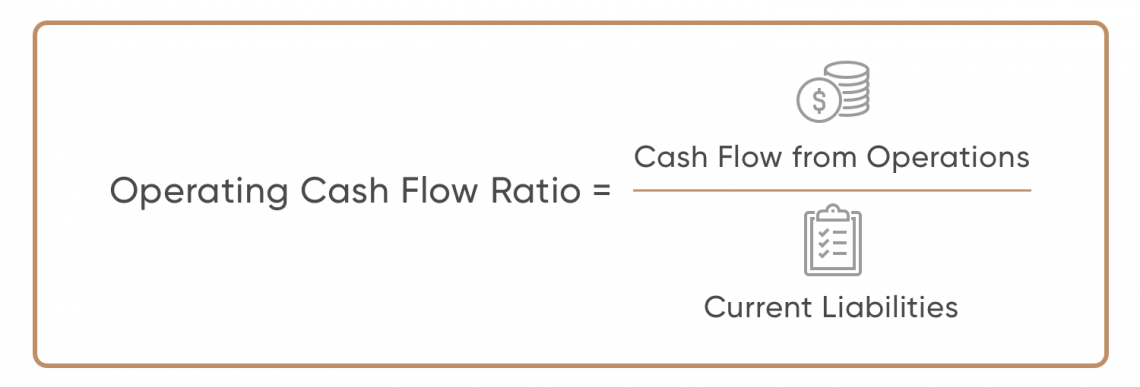

Calculated as cash flows from operations divided by current liabilities. Ideally the projects that a company chooses to pursue show a positive NPV even with worst-case assumptions regarding the discount rate used the tax rate or revenue growth rate.

Cash Flow Ratios Calculator Double Entry Bookkeeping

A much smaller ratio indicates that a business is deriving much of its cash flow from sources other than its core operating capabilities.

. Cash and cash equivalents Current Liabilities. If the ratio is anything above 1 it means that the company possesses excellent liquidity while anything below 1 implies its a weak CCR. Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth.

Cash Flows Provided by Operating Activities of 485 million an increase of 200 million. The level of cash flow that must be available to cover loans on an ongoing basis by 35 times net operating income or no net operating income or annual debt service. Banks normally require a ratio of one to one.

A ratio greater than 1 indicates good financial health as it indicates cash flow more than sufficient to meet short-term financial obligations. Anything negative suggests the company is incurring losses. The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a companys operations.

Operating cash flow ratio CFO Current liabilities. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations. Well while theres no one-size-fits-all ratio that your business should be aiming for mainly because there are significant variations between industries a higher cash flow margin is usually better.

The operating cash flow ratio is a measure of a companys liquidity. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. The capital acquisition ratio indicates the companys finance capital expenditures with internal sources.

This means that the operating cash flow margin for Aswac is 63. Thus investors and analysts typically prefer higher operating cash flow ratios. Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100 The figure for operating cash flows can be found in the statement of cash flows.

So a ratio of 1 above is within the desirable range. Essentially Company A can cover their current liabilities 208x over. Low cash flow from operations ratio ie.

If ancillary cash flows were to be included in operating cash flows it would imply that the entity is relying on non-core activities to support its core activities. What Is Ideal Dscr Ratio For Bank. MAT today reported fourth quarter and full year financial results.

This is because it shows a better ability to cover current liabilities using the money generated in the same period. Cash Ratio - breakdown by industry. Below 1 indicates that firms current liabilities are not covered by the cash generated from its operations.

Operating cash flow ratio analysis is an effective way to measure how well a company can pay off its current liabilities using the cash flow generated from ongoing business activities. A ratio less than 1 indicates short-term cash flow problems. Therefore a high ratio means that the company is less likely to require outside financing.

If the operating cash flow coverage ratio is greater than one as in the example above the company will have generated enough cash to pay off all their current. The resulting ratio from this calculation can be either a positive value or a negative value. Download the Free Template.

The ideal ratio is close to one. The CAPEX to Operating Cash Ratio is a financial risk ratio that assesses how much emphasis a company is placing upon investing in capital-intensive projects. This may signal a need for more capital.

Cash Flow From Operating Activities 2100000 110000 130000 55000 1300000 - 1000000 2695000 To arrive at the operating cash flow margin this number is divided by. Price to Cash Flow Ratio Calculated as the share price divided by the operating cash flow per share. Operating cash flow OCF is a measure of the amount of cash generated by a companys normal business operations.

You can work out the operating cash flow ratio like so. If this ratio is less than 11 a business is not generating enough cash to pay for its immediate obligations and so may be at significant risk of bankruptcy. A cash flow margin ratio of 60 is very good indicating that Company A has a.

This can be summarized as. In this example for every dollar made in net sales 063 is operating cash. Cash returns on assets cash flow from operations Total assets 500000 100000 Cash Returns on Asset Ratio 5 This means that the automaker generates a cash flow of 5 on every 1 of assets that it has.

9 2022 Mattel Inc. Operating cash flow ratio This ratio calculates how much cash a business makes as a result of sales. Example of the Operating Cash.

Capital acquisitions ratio cash flow from operating activities cash paid for property plant and equipment. Comparing it with other automakers in the economy an investor can identify how are the growth prospects of the firm. This ratio can help gauge a companys liquidity in.

You would get a negative cash flow if your DSCR was less than 10. A higher ratio is more desirable. Operating cash flow indicates whether a company can generate sufficient positive.

Listed companies included in the calculation. The operating cash flow margin of 63 is above 50 which is a good indication that the company is efficiently creating operating cash from its sales. If it is higher the company generates more cash than it needs to pay off current liabilities.

Ideally the ratio should be fairly close to 11. More about cash ratio. This ratio can be calculated from the following formula.

Calculation formula The formula for this ratio is simple. 250000 120000 208 This means that Company A earns 208 from operating activities per every 1 of current liabilities. 3968 year 2020.

Operating Cash Flow Margin Analysis. Cash Ratio Measure of center. Cash ratio is a refinement of quick ratio and indicates the extent to which readily available funds can pay off current liabilities.

A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate. Free Cash Flow of 334 million an increase of 167 million Company announces 2022 guidance and 2023 goals EL SEGUNDO Calif Feb.

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Formula How To Calculate Cash Flow With Examples

Operating Cash Flow Formula Calculation With Examples

Free Cash Flow Operating Cash Ratio Free Cash Cash Flow Flow

Operating Cash Flow Ratio Definition And Meaning Capital Com

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Operating Cash Flow Efinancemanagement Com

Operating Cash Flow Ratio Formula Guide For Financial Analysts