estate tax exemption 2022 inflation adjustment

These include increased gift estate and generation-skipping transfer tax GST exemptions and annual gift. The IRS has announced the 2022 inflation adjustments for many tax provisions including exemptions for estate gift and generation-skipping transfer taxes and the annual.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

The federal estate tax exemption for 2022 is 1206 million.

. The federal estate tax exemption for 2022 is 1206 million. Transfer tax exemption for death transfers lifetime gifts and generation-skipping transfers. 2021 Rates and 2022 Inflation Tables.

The 2022 increase of approximately 3 was not based on calendar year 2021. The IRS has released annual inflation adjustments for 2022. 2022 Annual Adjustments For Tax Provisions.

For assistance on navigating through the adjustments affecting estate and gift tax or to learn more about estate and gift tax please contact David J. The 2022 increase of approximately 3 was not based on calendar year 2021. The amount increased from 15000 in 2021.

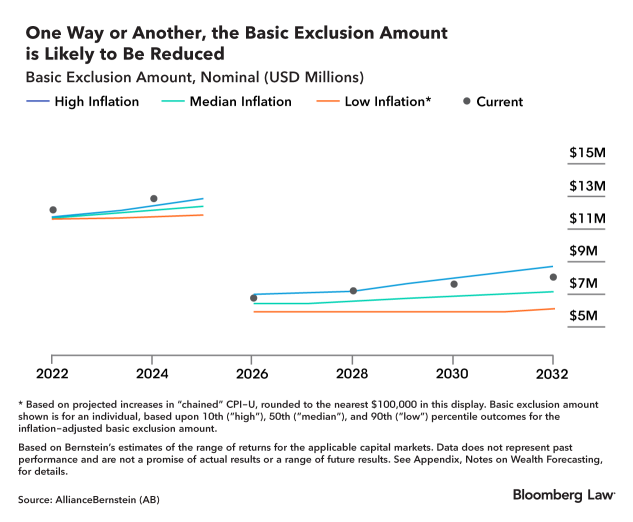

It is portable between spouses meaning if the right legal steps are taken a married couple can protect up to 2412. The inflation adjustment for the estate tax exemption has a delay in implementation. The estate tax exemption is often adjusted annually to reflect changes in inflation every year.

The federal estate tax exemption is 1206 million in 2022. Recently inflation has gone up significantly mainly due to the Covid-19 pandemic. The alternative minimum tax exemption for estates and trusts will be 26500 was.

On November 10 2021 the IRS released tax inflation adjustments for 2022. But its still a big deal when the new exemption is announced each year because theres a lot at stake for. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation.

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing. The estate tax exemption is adjusted for inflation every year. The inflation adjustment for the estate tax exemption has a delay in implementation.

We have compiled the new IRS annual cost-of-living adjustment. This exemption is limited to the fair cash value up to an annual maximum of 75000 or 25000 in assessed value which is 33 13 percent of fair cash. But its still a big deal when the new.

They include increased gift estate and generation-skipping transfer GST tax. The Internal Revenue Service recently released annual inflation adjustments for 2022. Beginning January 1 2022 Californias cannabis cultivation taxes increased to reflect an adjustment for inflation as required under the Cannabis Tax Law.

The amount is adjusted each year for inflation so thats not a surprise. The amount is adjusted each year for inflation so thats not a surprise. Notably the federal estate and gift tax exemption amount will increase from 117 million to.

The top 37 income tax bracket for estates and trusts will begin at 13450 was 13050. The annual inflation adjustment for federal gifts. The federal estate tax exemption is going up again for 2022.

Increased Us Gift And Estate Tax Exemptions And Further Planning Opportunities In 2022

Scanning The Horizon In A Sea Of Noise Rockefeller Capital Management

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Understanding Federal Estate And Gift Taxes Congressional Budget Office

2021 Taxes 8 Things To Know Now Charles Schwab

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

Inflation Pushes Income Tax Brackets Higher For 2022

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning

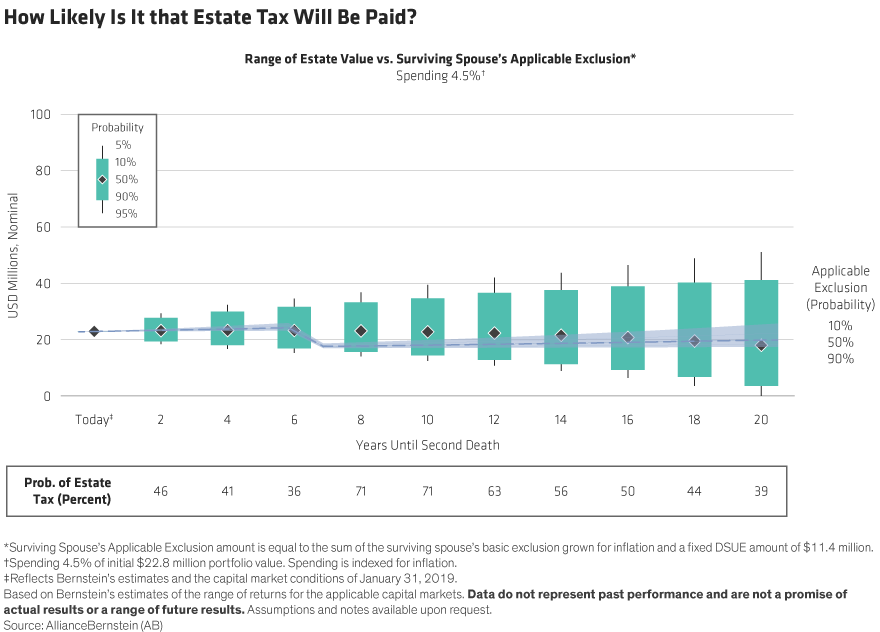

Will Your Estate Be Taxable In The Future Context Ab

2022 State Tax Reform State Tax Relief Rebate Checks

Executive Tax Reference Guide Northern Trust

Paul Neiffer When Can Inflation Help You Agweb

The Estate Tax And Lifetime Gifting Charles Schwab

2022 Tax Inflation Adjustments Released By Irs

Inflation Adjusting State Tax Codes A Primer Tax Foundation

Four More Years For The Heightened Gift And Tax Estate Exclusion